Blogs

“Third-Party Posts”

The following link/content may include information and statistical data obtained from and/or prepared by third party sources that Mott Tax Advisory Services, deems reliable but in no way does Mott Tax Advisory Services guarantee its accuracy or completeness. Mott Tax Advisory Services had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Mott Tax Advisory Services. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Mott Tax Advisory Services, execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

Federal Reserve data shows sharp rise in amount Americans 65 and older owe Americans across generations are carrying more debt than they did three decades ago,...

3 Changes Coming To Retirement Required Minimum Distributions in 2025

Saving and investing early, often, and continuously throughout your entire working career is absolutely critical to securing your financial future in retirement. Making...

3 Changes Are Coming to 401(k) Plans in 2025

Three significant 401(k) plan changes coming in 2025 are worth paying attention to, regardless of when you plan to retire, whether you work full-time or part-time, or...

7 Things to Know About Working While Getting Social Security

If you claim benefits early, income from work can reduce your monthly payments “Retirement” used to be synonymous with “not working.” Not anymore. More than a quarter...

Weekly Market Commentary

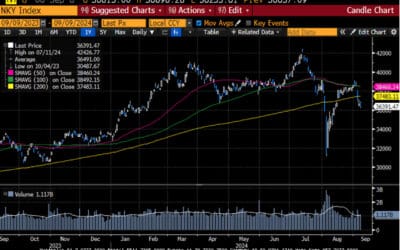

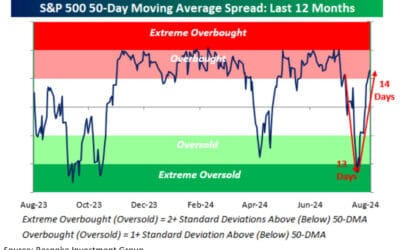

-Darren Leavitt, CFA Global equity markets tumbled due to economic growth concerns as the US Treasuries extended their gains from August. The holiday-shortened week...

Weekly Market Commentary

-Darren Leavitt, CFA The final week of August was all about NVidia's second-quarter earnings results and the Fed's preferred measure of inflation, the PCE. Expectations...

Weekly Market Commentary

-Darren Leavitt, CFA US financial markets inked another week of gains as investors cheered what they heard from global central bankers at the Jackson Hole Economic...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Alan Mott) or (Mott Tax Advisory Services) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Mott Tax Advisory Services.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

Tapping an ESA for Back-to-School Expenses

By Sarah Brenner, JD Director of Retirement Education It’s August and that means it is back-to-school time! The 2025-2026 school year is upon us. Kids are already back...

The Once-Per-Year Rollover Rule and SEP IRA Contributions: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: I recently retired in January and rolled over a lump sum pension from my previous employer into my IRA....

The Craziest Stuff I’ve Heard

By Andy Ives, CFP®, AIF® IRA Analyst The Ed Slott team has answered literally tens of thousands of IRA and retirement plan questions over the past few years. That is...

In ERISA Retirement Plans, Spouse Beneficiaries Rule

By Ian Berger, JD IRA Analyst At Ed Slott and Company, we continually stress how important the beneficiary designation form is. Because it’s that form – and not...

Required Minimum Distributions and IRA Beneficiaries: Today’s Slott Report Mailbag

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: I turn age 73 on December 1, 2026. I would like to do a Roth IRA conversion on January 1, 2026, prior to turning 73 years...

5 Random Retirement Account Trivia Questions

By Andy Ives, CFP®, AIF® IRA Analyst Are the current tax brackets, made “permanent” by OBBBA, really here forever? Not necessarily. The One Big Beautiful Bill Act...

QCDs and 529-to-Roth IRA Rollovers: Today’s Slott Report Mailbag

By Ian Berger, JD IRA Analyst Question: I am 70 years old and do not have to start taking required minimum distributions (RMDs) for three years. Can I do a qualified...

Six Unanswered Questions on Trump Accounts

By Ian Berger, JD IRA Analyst A recent Slott Report article discussed “Trump accounts,” the new savings vehicle for children created by the One Big Beautiful Bill Act...

Mr. T: “I Pity the Fool Who Misses Their RMD”

By Sarah Brenner, JD Director of Retirement Education Laurence Tureaud, born May 21, 1952, is better known as Mr. T. He is an actor and a retired professional wrestler....

The following link/content may include information and statistical data obtained from and/or prepared by thirdparty sources that Mott Tax Advisory Services, deems reliable but in no way does Mott Tax Advisory Services guarantee its accuracy or completeness. Mott Tax Advisory Services had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Mott Tax Advisory Services. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Mott Tax Advisory Services, execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

How Medicare Advantage In-Home Health Assessments Keep Seniors Healthier

Today, Medicare Advantage delivers affordable, high-quality care to more than 33 million seniors and people with disabilities, with better health outcomes than Fee-for-Service Medicare (FFS). One of the most effective ways to ensure seniors receive comprehensive care...

Does your Medicare plan cover gym memberships and other fitness benefits?

There’s no age limit on exercise – physical activity is for everyone! In fact, as you get older, physical activity becomes an even more important part of your overall health. According to the Centers for Disease Control and Prevention, regular exercise can help...

Financial Services

Insurance Services

Educational Blogs

Tax Preparation

Mott Tax Advisory Services Location

North Brunswick, New Jersey

2864 Hwy 27 Suite #F

North Brunswick, NJ 08902

Toll Free: (800) 259-1001

Local: (732) 297-3355

Fax: (732) 297-3323

Alan.Mott@nsac.net